Economy

-

The real estate frenzy is over

With surging home prices and mortgage rates, we are approaching housing affordability levels not seen since the housing bubble that led to the Great Financial Crisis. The chart below from Bill McBride’s Calculated Risk newsletter shows this effect accelerating throughout the past few years. But signs of relief are signing to show. According to Mike […]

-

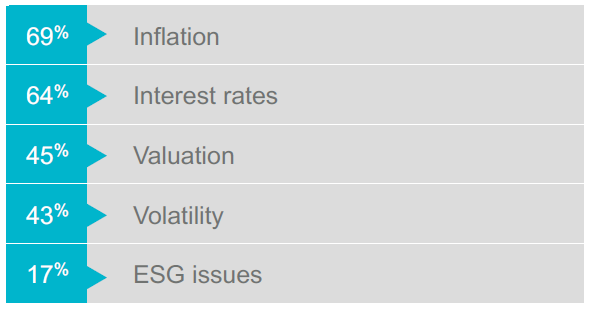

Taking a fresh look at investing reserves for institutions

According to the 2022 Global Institutional Investor survey (Natixis), the two biggest concerns for institutional investors in 2022 are inflation and interest rates. It isn’t hard to see why. The global economic slowdown caused by the pandemic sent interest rates plummeting to record lows during the summer of 2020 (MarketWatch), which is why the last […]

-

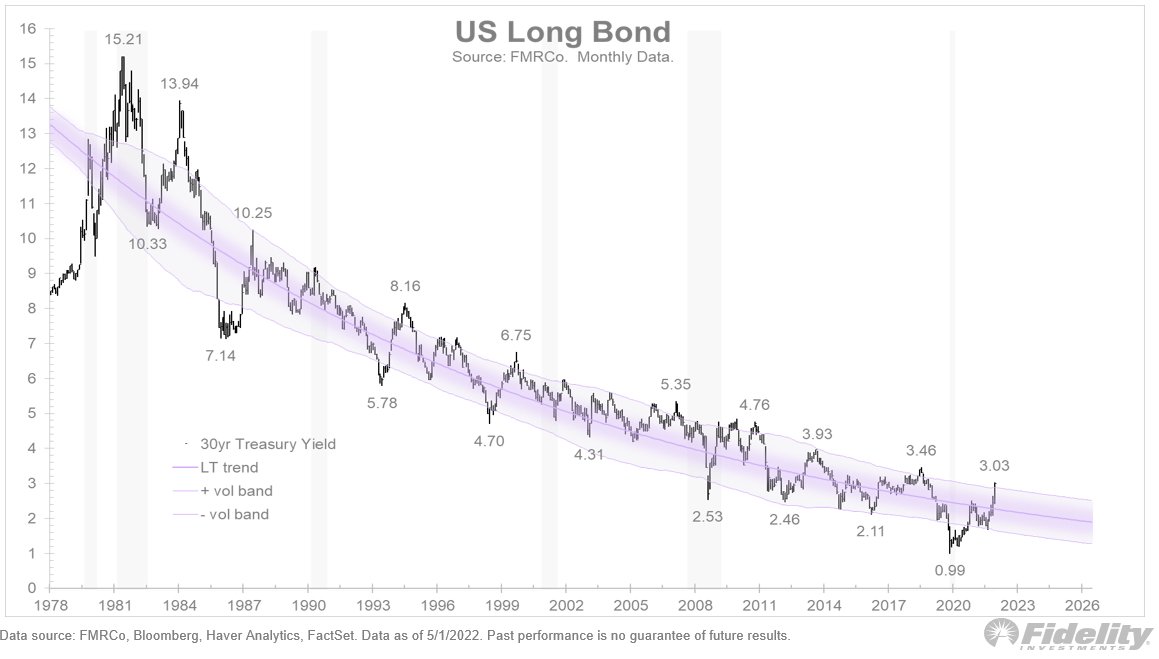

Much ado about rates (and just how much pain is left for bond investors?)

Even if you are not the type that reads the Wall Street Journal every day, interest rates have become downright buzzworthy. It is not often that a simple economic concept enters the lexicon of cocktail parties and casual office water cooler talk alike. Let’s start with the facts. Thirty year mortgage rates have gone from […]

-

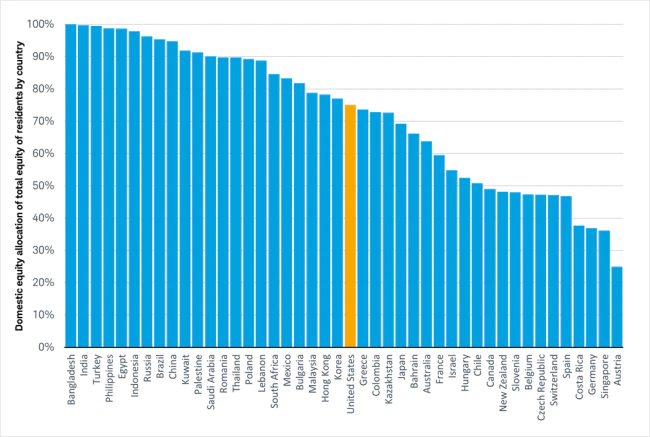

The Long and Short of “Home Country” Bias

No doubt about it, humans are social creatures. We tend to mimic the behaviors of those around us. Evidently, this extends to our portfolios as well. Investors around the globe tend to mostly own stocks from their own home country, regardless of the size of their country’s stock market. After reviewing the below graphic from […]

-

Remember market corrections? They are happening faster.

Well things have sure accelerated quickly. My previous post outlining the resiliency of the market debuts and almost immediately becomes old news. Markets have turned down sharply in just the last few sessions. What are we to make of it? If we specifically look at just Monday, we see price movement that looks like a […]

-

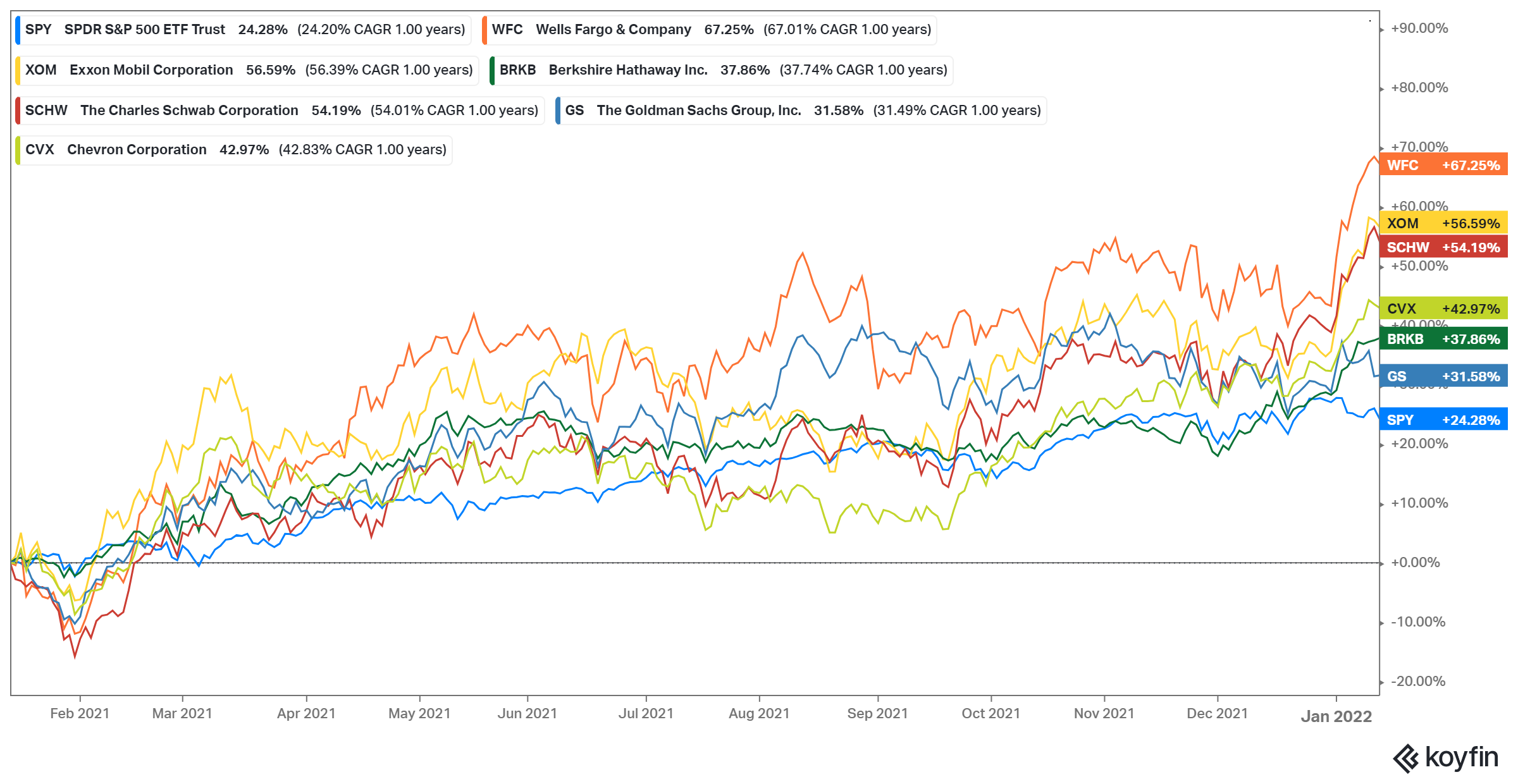

So how is the stock market really doing?

Inflation hit 7% in December, the highest since 1982. Omicron shows no signs of slowing. So why isn’t the stock market down more right now? The S&P 500 continues to be resilient in the face of it all, less than 3% off all-time highs: Big tech is holding up well also, down only 4% from […]

-

Balancing the Inflation Tightrope Act: Should You Be Worried?

As the world recovers from COVID19, its now the world’s economies that are running hotter than predicted. But with growth has come a surprising change. The sharp increase in inflation blindsided many economists and almost no one saw it coming. This year, inflation has been the least predictable it’s been for a long time, probably […]

-

New Direction for Potential Tax Legislation?

After a week of backdoor negotiations between President Biden and key Democrat holdouts Senators Joe Manchin and Kyrsten Sinema, the White House and progressive Democrats appear prepared to compromise on some significant priorities in order to cobble together a social spending package that can pass Congress.

-