So how is the stock market really doing?

Inflation hit 7% in December, the highest since 1982. Omicron shows no signs of slowing. So why isn’t the stock market down more right now?

The S&P 500 continues to be resilient in the face of it all, less than 3% off all-time highs:

Big tech is holding up well also, down only 4% from its highs:

Smaller companies stocks are currently in a correction, down more than 11%:

But what if we take a look underneath the hood? Let’s start with former pandemic darlings: Peloton, Zoom, and DocuSign. All are down significantly from their highs.

So the broader indices are faring better than a few companies that clearly got out too far over their skis. I guess that shouldn’t be too big of a surprise. After all, it has been the handful of behemoth tech companies that have been providing the bulk of returns, right?

Collectively, Apple, Microsoft, Alphabet, Amazon, Tesla and Meta (Facebook) make up 25% of the S&P 500. However, all six are down more than the market right now.

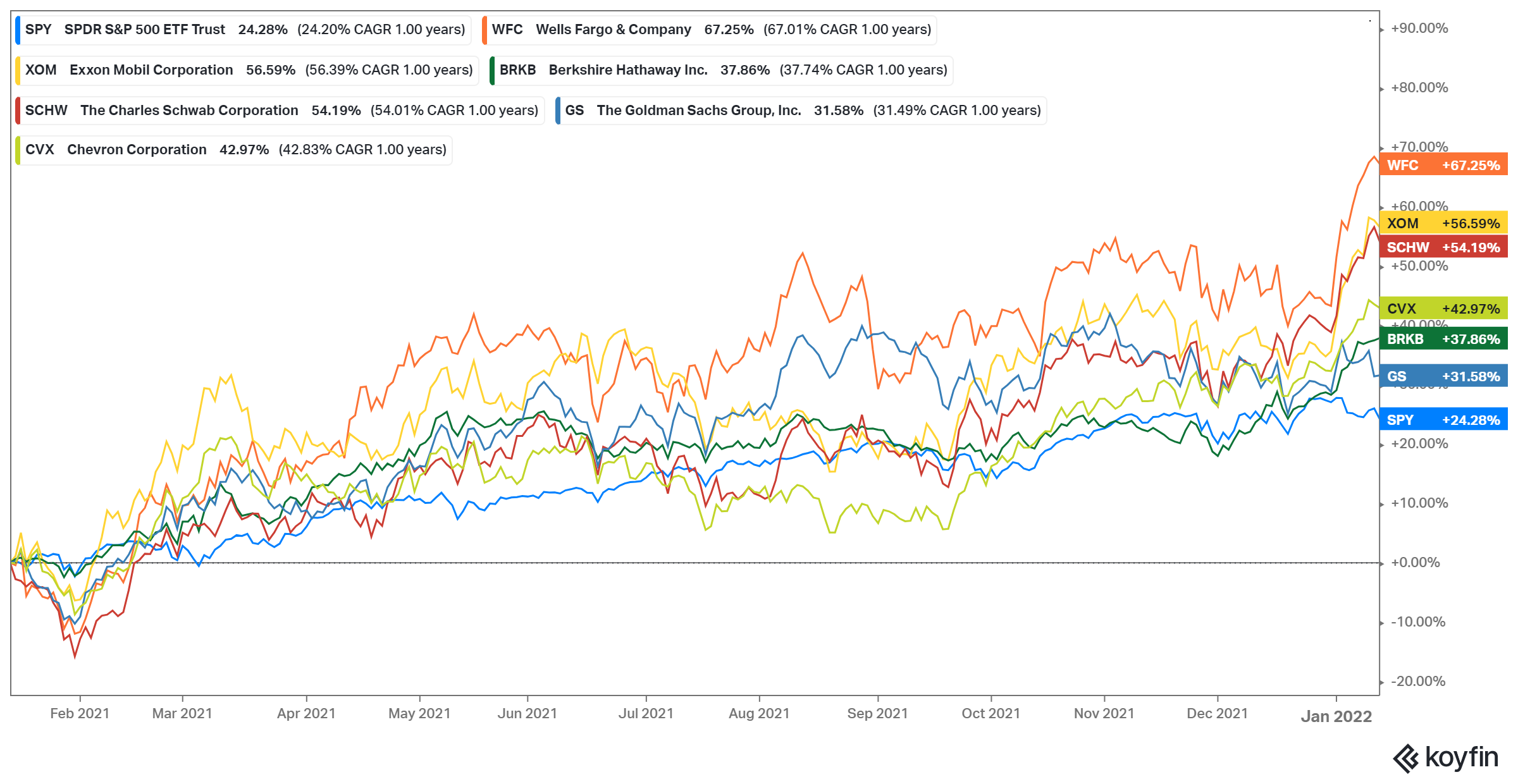

When we look at performance broken out by sector, energy, real estate and financials are leading the way and outperforming the overall S&P 500 (SPY) return of 24.8%.

These are not the most exciting areas of the market, so it’s not too surprising that many investors may have missed this rotation. Basically, we have seen the market begin to favor boring old value stocks again at the expense of high-flying growth stocks.

Not too long ago, energy and financials were seemingly left for dead. But a recovering economy and health dose of inflation have given new life to those sectors.

Investors who stayed patient and stayed diversified have again come out on top. Not only can diversification help manage portfolio risk, it takes a significant amount of guesswork off the table.

Charts and data used in this blog post were found at Today’s Markets (koyfin.com).

[…] things have sure accelerated quickly. My previous post outlining the resiliency of the market debuts and almost immediately becomes old news. Markets have […]