The Long and Short of “Home Country” Bias

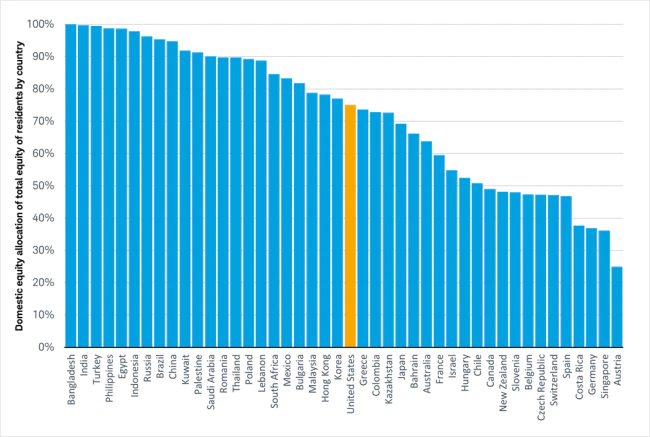

No doubt about it, humans are social creatures. We tend to mimic the behaviors of those around us. Evidently, this extends to our portfolios as well. Investors around the globe tend to mostly own stocks from their own home country, regardless of the size of their country’s stock market. After reviewing the below graphic from Schwab, it becomes quite evident that investors like to keep things close to home.

Luckily, we as Americans have the good fortune of our domestic stock market currently making up over 60% of the entire global market (MSCI) and being generally well-diversified across many sectors of the economy. But what about our friendly neighbors to the north? While Canada only makes up 3% of the global stock market (MSCI), Canadians have about 50% of their stock holdings in their own market. In addition, the Canadian stock market is very concentrated in only three sectors: Financials (39%), Energy (17%), and Materials (12%) according to MSCI.

If we remind the past 10 years of stock returns, the U.S market (as evidenced by the S&P 500) is up of 14% annually versus only 5.2% for the Canadian market. But Canada is not alone in this underperformance against the U.S market. Similarly, international stocks (as illustrated by the MSCI EAFE) as an entire group have lagged U.S. stocks.

So what is so great about international diversification if diversification only means you underperform? One of the difficult parts of investing is accepting the fact that market trends can last for many years (even decades) before reversing. This graphic from J.P. Morgan perfectly illustrates this concept:

While it is not always entirely clear what causes these regime shifts, international stocks have tended to outperform U.S stocks during periods when long-term inflation expectations are rising, as evidenced by the below from Schwab.

With inflation expectations at their highest level in a decade (Schwab), could this be the catalyst to thrust international stocks back in favor? No one knows for certain. But it could be an opportune time to take a look at your portfolio and see just how much of a “home country” bias you may have.

Because while the U.S market has treated investors to better returns in recent years, history has taught us that things are more likely to change than stay the same. And diversification is the best tool we have to acknowledge that reality.

Charts and data used in this blog post were found at Today’s Markets (koyfin.com).