Accounting considerations for Financial Institutions that funded Payroll Protection Program (PPP) loans

Many lenders are participating in the PPP and loans are currently being disbursed to borrowers across the country. These loans contain complex accounting considerations such as deferred fees, guarantees, and loan forgiveness. Our summary of the primary accounting considerations financial institutions should consider over the life of the PPP loans is included below.

|

Record the loan. Record a receivable from SBA. The financial institution should record a loan to the borrower and a receivable from the SBA for the processing fee at the time funds are disbursed to the borrower. The PPP loan is legally binding and amounts will be repaid either by the borrower or through the SBA forgiveness and/or guarantee mechanism. The SBA guarantee cannot be separated from the loan and therefore is not a separate unit of account. The guarantee should be considered in evaluating the allowance for loan losses by the financial institution, but the risk of loss is not considered to be zero. Similar to letters of credit or unfunded commitments, a small qualitative factor may suffice, however, unlike letters of credit or unfunded commitments, the loan is on-balance sheet and funded so the amount would be recorded in the allowance for loan losses and not as an other liability. |

|

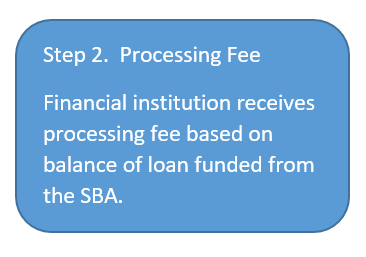

Record net deferred loan fees. Relieve receivable from SBA. When the fee is received from the SBA, the receivable from Step 1 will be relieved. The financial institution should treat this processing fee as a net deferred loan fee and amortize in accordance with ASC 310-20 over the life of the loan. This treatment is consistent with recognition of fees for existing loan types. Financial institutions would also need to consider other loan costs to defer. Typically, we would see a deferral period of two years, adjusted for any prepayment and/or forgiveness. Note that there may be a practical solution of recording processing fees and related loan costs on a cash basis, if you are able to prove things, such as; (1) the related fees and costs are immaterial to the financial statements, and (2) the majority of the financial institutions PPP loans are originated with anticipated significant forgiveness prior to June 30. This would result in the majority of the fees and costs being recognized in the same quarter under either the cash method or under ASC 310-20, resulting in the same pre-tax net income under both methods. |

|

Accrue interest. The financial institution should accrue interest at the stated rate of 1% on the outstanding principal amount of the loan. This amount will be repaid either by the borrower or through the SBA forgiveness and/or guarantee mechanism. |

|

Continue to accrue interest. Once the financial institution has obtained appropriate documentation from the borrower, they will review and, in turn, submit a report to the SBA and wait on the SBA to determine if the underlying criteria for loan forgiveness has been met for all or a portion of the loan. Interest continues to accrue during this time. |

|

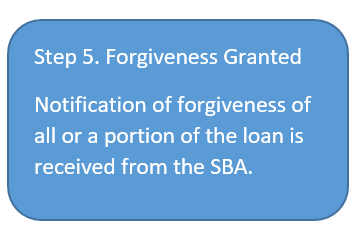

Reclass loan to receivable from SBA. Accelerate recognition of net deferred fees. Stop accrual of interest on forgiven amount. Upon receipt of the notification from the SBA of the amount of the loan to be forgiven, that portion of the loan balance should be reclassified from loans receivable to receivable from SBA on the balance sheet and for regulatory reporting purposes. The institution will then communicate the forgiven amount to the borrower. In addition, accelerated recognition of deferred net loan fees will occur for the percentage of loan forgiven. Similar to a prepayment, accrual of interest on the amount of the loan forgiven should stop on the date notification is received from the SBA. |

|

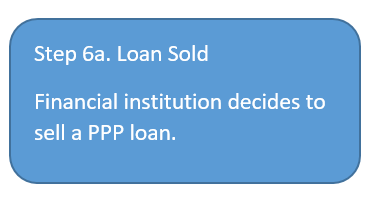

Reclass loans to loans held for sale. If a financial institution makes the determination to sell a loan, the loan should be reclassified from loans receivable to loans held for sale. It is anticipated that although there is an underlying guarantee, these loans could be sold at an amount below par given the costs of servicing the portfolio and the 1% interest rate. At the point when the loan is sold, any remaining net deferred fees would be derecognized. Any resulting gain or loss on loans sold will be recognized at the time the loan sale is completed. |

|

Record a receivable from SBA. Financial institutions will need to monitor loans throughout the two-year maturity term of the loan. If during either the six-month deferral window of principal and interest or at any point in time afterwards, it becomes known that the non-forgiven portion of the loan will not or cannot be repaid by the borrower, the financial institution should seek the guarantee from the SBA. The subsequent accounting would follow Step 5 above. |

|

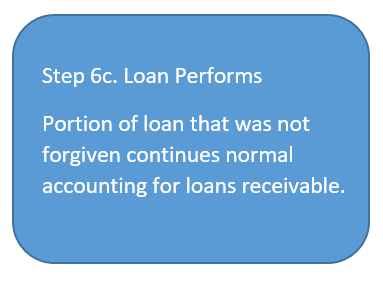

Record collection of principal and interest. The financial institution should continue to record accrual of interest and apply borrower payments like any other performing loan. |

CLA is here to help. Please contact us.

Scott is the leader in CLA’s Financial Institutions group, and a member of the National Assurance Technical Group. He has 15 years of experience with audit and accounting services for financial institutions of all sizes.

Thanks for the article Scott, i thought it was well written and easy to understand. We are a small community bank, approaching $250 million in assets. We do not follow FASB 91 and defer our loan fee income, then amortize over the life of the loan. Our current loan fees are not material to the income statement. However, the SBA PPP fees will be material. Should these SBA fees blend in with the interest margin, similar to current loan fees, or should they be booked to non-interest income?