Accounting Considerations for Visa Class B Conversions

This blog was authored by my colleague Scott Klitsch, the managing principal of the financial services quality group.

Update as of April 16, 2024: Visa has formally issued their Prospectus on April 8, 2024. Holders of Visa Class B-1 shares have until 11:59 pm New York City time on May 3, 2024, to tender their shares. Participating Class B-1 stockholders must deliver executed copies of the Letter of Transmittal and Makewhole Agreement, including the officer’s certificates appended thereto, to the Exchange Agent. A copy of the Prospectus with further specific instructions can be found here.

Many financial institutions hold Visa Class B shares which were created in 2007 as part of the Visa IPO process. Class B shares were created to provide protection to Class A and C shares from certain litigation. Although much of that litigation has settled, holders of Class B shares have had limited access to liquidity. In late 2023, Visa proposed an amendment to their certificate of incorporation that would create a path to release transfer restrictions on a portion of the current Class B shares outstanding. This matter went to a vote of Visa shareholders on January 23, 2024, and was approved. On January 29, 2024, Visa released an offer to exchange to Class B shareholders.

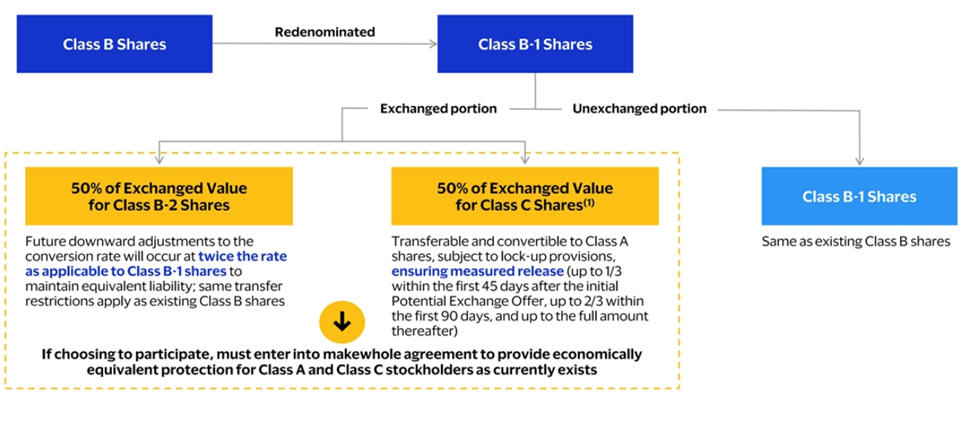

As part of the exchange process, all holders of Class B shares will have those shares redenominated into a new Class B-1 share with the same rights as existing Class B shares. From here, each holder of the newly created Class B-1 shares will have the option to either 1) do nothing, 2) exchange all of their Class B-1 shares to 50% equivalent value of Class B-2 Shares and 50% equivalent value of Class C shares, or 3) something in between. For those choosing to exchange their Class B-1 shares, an additional makewhole agreement will be required to be signed.

The new class B-2 shares will have a future downward adjustment to the conversion rate at twice the rate as applicable Class B-1 shares to maintain an equivalent liability to the outstanding litigation. The Class C shares will be transferable and convertible to Class A shares subject to a measured lock-up provision of 1/3 during the first 45 days, 1/3 during the next 45 days and 1/3 thereafter. The below graphic was included within the original Visa shareholder presentation from September 13, 2023.

Our summary of the primary accounting considerations financial institutions should consider as part of the exchange is included below.

| Does the redenomination from Class B to Class B-1 result in any change in basis? | No. The financial institution should continue to record the investment at the same cost basis as prior to the redenomination with no adjustment to fair value. |

| Does the exchange of Class B-1 to Class B-2 result in any change in basis? | No. The financial institution should continue to record the investment at the same cost basis as prior to the redenomination with no adjustment to fair value. |

| Does the exchange of Class B-1 to Class C result in any change in basis? | Yes. The new class C shares should be recorded at the associated fair value of the converted Class A shares. This change in basis would be recorded through income in the period of exchange. |

| How should the lockout period sale restriction be accounted for during the period of time between exchange and release of the sales restriction? | FASB ASU 2022-03 clarifies that a “contractual sale restriction prohibiting the sale of an equity security is a characteristic of the reporting entity holding the equity security” and is not included in the equity security’s unit of account. Accordingly, a financial institution should not consider the contractual sale restriction when measuring the Visa share’s fair value. |

| How should subsequent changes in value of Visa Class A stock be recorded? | ASC 321 – Investments – Equity Securities would call for the fair value of the Class A shares to be adjusted to fair value through income at each reporting period. |

| Does the makewhole agreement result in a liability being recorded? | As a condition to participating in the exchange, each Class B-1 holder must enter into a makewhole agreement. Cash payment obligations under the makewhole agreement will arise under certain circumstances as defined in the agreement. Any makewhole payments would be in an amount equivalent to the loss in value that would have incurred had the financial institution not participated in the exchange. ASC 450-20 – Loss Contingencies would apply to this makewhole agreement. An estimated loss from this contingency would be accrued if the loss was both probable of occurring and the amount of loss could be reasonably estimated. In addition, financial institutions should consider disclosure in the footnotes to the financial statements related to the makewhole agreement if the threshold for accrual is not met. |

How can we help?

CLA’s Financial Services Group is filled with experienced professionals. Please Contact Us to assist your institution with accounting and advisory services.

Dean has more than 25 years of experience providing audit, internal audit, and consulting services to financial services companies. He has provided consulting services in the areas of business lending, product costing and profitability, and asset/liability management. Dean has worked with a number of financial services companies on strategic issues such as board governance and enterprise risk management, as well as the role of internal audit and risk management, regulatory issues, and many accounting related topics.

Comments are closed.