Taking a fresh look at investing reserves for institutions

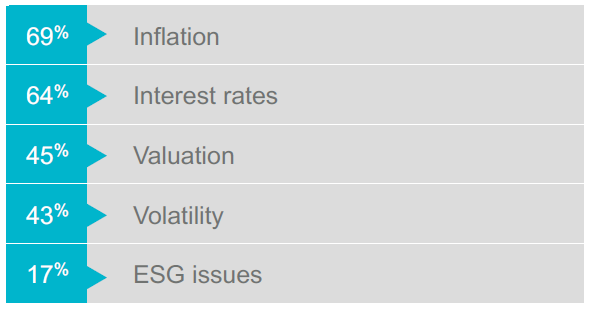

According to the 2022 Global Institutional Investor survey (Natixis), the two biggest concerns for institutional investors in 2022 are inflation and interest rates. It isn’t hard to see why.

The global economic slowdown caused by the pandemic sent interest rates plummeting to record lows during the summer of 2020 (MarketWatch), which is why the last two years have been so difficult for institutional investors looking for safe, shorter-term yields. But as inflation recently hit levels not seen since the early 1980s (CBS News), the Federal Reserve has been forced to raise interest rates to try to combat rapidly rising prices.

Long the barometer for all other interest rates, the 10-Year U.S. Treasury yield is currently 2.84% after falling as low as 0.52% in July 2020 (FRED). In fact, the 10-Year Treasury yield is finally outpacing the expected inflation rate over the next ten years, as seen in the graphic below from the St. Louis Fed. For the first time since the pandemic began, institutions are able to again invest the fixed income portfolio of their reserves with the expectation of keeping up with inflation, or even exceeding it.

For additional commentary on whether now is a good time to invest in bonds, please see the following post: Much ado about rates (and just how much pain is left for bond investors?) | CLA (CliftonLarsonAllen) (claconnect.com)

Historically, investors have been able to get risk-free interest from both FDIC-insured bank accounts in addition to U.S Treasuries. However, this time may be different. According to Ken Tumin, founder of DepositAccounts.com, “banks have few incentives now to offer attractive deposit rates because they’ve been flush with funds since the earliest days of the pandemic” (Barron’s). This could mean that investors may need to look to the bond market for yield instead of waiting for their savings account interest rate to recover.

CLA’s Nonprofit Investment Advisory + Consulting Services were developed to help nonprofits fulfill their philanthropic mission and navigate through financial uncertainty by leveraging our expertise in nonprofit finance, cash and reserves management, risk management, and investing.

To find out more about managing reserves for nonprofit institutions, please see the following post: Nonprofit strategies for managing reserves | CLA (CliftonLarsonAllen) (claconnect.com)