Problem Loan Management – Action Plans

This blog was authored by my colleagues Erica Crain, Manager of National Credit Risk Services and Monica Bolin, Director of National Credit Risk Services. In this three-part series, our goal is to provide considerations for evaluating the overall problem loan management function as we continue to navigate the economic impacts of the COVID-19 pandemic. In this final part our problem loan management series, we turn our focus to action plans.

Regardless of the word you use to describe 2020, change was the common theme. Not only has the last year changed the way we identify problem loans, but it has changed the way we approach problem loans as well. Although U.S. corporate debt has soared to record levels, special asset departments for many financial institutions have decreased. While resources are low and changes, like government-assisted lending facilities and loan modifications, are significant, the challenge to devise and implement effective loan workout action plans grows.

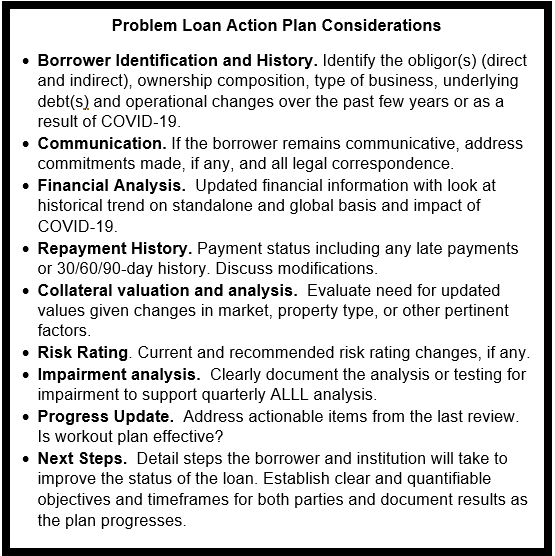

In the face of this change, we highlight the significance of timely and thorough action plans. Although this is not a new practice, the routine nature of completing a quarterly problem loan action report deserves a new look. All financial institutions have been and continue to be affected by a changing economic climate and the ongoing global pandemic. As such, institutions of all sizes must address problem loans and develop plans to mitigate exposure. Problem loan action plans are a way for management to track and document what is going on with each borrower, what root issue caused the problem, and next steps that can be taken to reduce the credit risk exposure to the institution.

Many of our financial institutions are managing the latest round of Paycheck Protection Program loans, calculating forgiveness from the first round, catching up on overdue annual reviews and performing other day-to-day operational requirements. As noted, resources are low and proactive problem loan management can easily be pushed to the side. However, the key piece to developing viable action plans includes regular, clear communication with the borrower. Maybe you’ve heard the phrase “you don’t know what you don’t know”. Open communication with the impacted borrower can provide management with the insights needed to determine the appropriate strategies or changes, if any, that may further impact repayment capacity.

Lenders should consider not only the borrower’s financial position but their operations as well. More specifically, for commercial borrowers, evaluating future opportunities based on existing demand, new business models, and potential supply chain disruption are realities to address in a problem loan action plan or strategy. For illustrative purposes, let’s use a commercial real estate example such as office space. For an impacted borrower in your portfolio, the problem loan action plan should consider what market conditions are prevailing and if new business models (i.e., online versus in-person) are impacting current and future performance. One consideration in the problem loan action plan could be if larger spaces are becoming more marketable as they provide the workforce with appropriate social distancing or is there a decreased presence as businesses may have moved to a remote work environment.

Problem loan action plans are also beneficial for appropriate internal communication with management and staff of the financial institution. At a time when unexpected employee absences are anticipated, these plans can ensure all necessary parties remain informed and moving forward with the plan of action as outlined. Updating problem loan action plans (at least quarterly) and maintaining a current record in the borrower file is essential. More formal documentation is typically required for those credits with balances exceeding an established threshold internally and is communicated to the appropriate governing bodies such as the board of directors or a designated committee thereof.

Problem loan action plans are key tools to support an effective problem loan management program. Just remember the saying, “garbage in, garbage out”. If less than valuable information or marginal attempts are made to execute a problem loan action plan, then it’s hard to expect impactful results. While government funding may have tempered the financial difficulties for many borrowers in the current environment, a pro-active approach requires institutions to be addressing problems that are anticipated as government support subsides.

How Can We Help?

CLA can help you navigate the challenges of problem loan management. Our credit risk management team is comprised of long-term industry professionals with experience in problem loan management. Join our webinar on March 2, 2021 where we will discuss this topic and answer your questions.

Susan is a CPA with more than 20 years of combined experience in public accounting and the financial institution industry, including experience with Fortune 500 financial services companies. Susan serves as the managing principal of CLA’s financial services group. Her responsibilities include providing engagement oversight in the areas of assurance and internal audit. In addition, Susan provides board advisory and management consulting services in the areas of strategic planning and mergers and acquisitions. Susan has been involved in multiple mergers and acquisitions of sizes ranging from $150 million to $500 billion with engagement at all stages of the process.

Comments are closed.