Reporting Loan Modifications with the Implementation of CECL

This article was originally published on June 7, 2023. It has been updated on June 28, 2024 to reflect current information.

This blog was co-authored by my colleague Andy Oster, Manager

As a part of the adoption of CECL, institutions are also adopting ASU 2022-02 Financial Instruments – Credit Losses (Topic 326), Troubled Debt Restructurings and Vintage Disclosures. This standard eliminates the concept of a troubled debt restructuring (TDR). As a result of this elimination, it removes the requirement to individually evaluate TDRs for impairment as CECL is already calculating lifetime losses for all loans in the portfolio. Under CECL, you are allowed to individually evaluate loans for allowance levels, but this evaluation is no longer predicated on the prior definition of an impaired loan. However, the standard did not eliminate the requirement for institutions to disclose information about loan modifications where the borrower is experiencing financial difficulty. Institutions should establish a process to determine if a loan modification meets these criteria, and thus would be included in its disclosures.

The first step in the process is to determine whether the modification is a new loan or a continuation of an existing loan. A loan modification would be classified as a new loan if:

- The terms of the new loan (including its interest rate) are at least as favorable to the lender as the terms with customers with similar collection risks that are not refinancing or restructuring their loans, and

- The modification to the terms of the loan is more than minor. A modification is considered more than minor if the present value of the cash flow differs from the loan balance by greater than 10%.

In the context of determining whether a loan modification is required to be disclosed, institutions should focus on the first bullet point. If you cannot conclude the modification meets the first criteria, it is not considered a new loan, and the modification was made to a borrower experiencing financial difficulty and must be disclosed through the new enhanced disclosure requirements of the ASU. Institutions should establish appropriate internal controls to identify these loan modifications to borrowers experiencing financial difficulty to ensure these loans are appropriately disclosed on their call reports and financial statements.

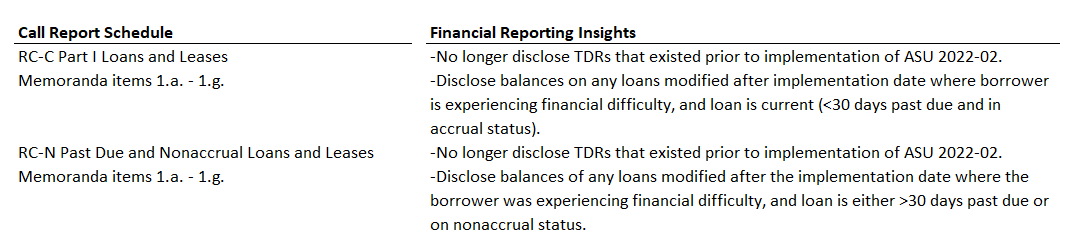

The call report forms and instructions are updated in June 2024 to include in the item descriptions and instruction references to “loan modifications to borrowers experiencing financial difficulty” and remove references to the TDR framework. These modifications will continue to be reported separately by those that are and are not in compliance with their modified terms.

Banks

Credit Unions

The June 30, 2023 NCUA call report instructions note for Schedule A: “If you have adopted ASC Topic 326: Financial Instruments – Credit Losses (CECL), for borrowers experiencing financial difficulty report the number and amortized cost of loan modifications resulting in a new loan or a continuation of the current loan. Report loan modifications in the form of any of the following: principal forgiveness, an interest rate reduction, a significant payment delay, or a term extension (or a combination thereof). Covenant waivers and modification of contingent acceleration clauses are not considered term extensions. Upon adoption of CECL, which includes amendments by ASU 2022-02 – Troubled Debt Restructurings and Vintage Disclosures, report the number of loan modifications granted in Account 1000F and the amortized cost in Account 1001F starting from the implementation date of CECL, instead of TDRs.”

Financial Statement Disclosures

For financial statement disclosure, ASC 310-10-50 indicates that institutions should disclose any commitment to lend additional funds to borrowers experiencing financial difficulty. The financial impact, past due status, and commitment amount of the following loan modification types should be disclosed:

- Principal forgiveness

- Interest rate reduction

- Other-than-insignificant payment delays

- Term extensions, and

- Any combination of these modification types.

Institutions should develop a way to track such modifications, by modification type, on an individual loan basis to fulfill the disclosure requirements.

How can we help?

CLA’s Financial Services Group is filled with experienced professionals, here to assist your institution with your CECL and Loan Modification needs. In addition, we did a full series of blog posts on CECL in 2021. See the first blog post from July 2021 here.

David is a principal with the financial institutions group, dedicated to certified audits, directors’ examinations, internal audits, and general control reviews. David began his career with CliftonLarsonAllen in 2005, and has twelve years of experience working with financial institutions.

Comments are closed.