Mail Theft and Fraud and SARs…“Oh My!” FinCEN Alert on Mail Theft and SAR Requirements

Have you heard that checks are a dying breed? The industry has been saying that longer than I have been in banking, and that more than half the time I have been alive, yet checks are still being negotiated! According to an article by the Federal Reserve Bank of Atlanta, while checks as a preferred method decreased 23% between 2015 to 2018, the average dollar amount per commercial check has been increasing annually.

In February 2023, the Financial Crimes Enforcement Network (FinCEN) published an alert, FIN-2023-Alert003, as a response to the surge in check fraud schemes. FinCEN states that “Fraud, including check fraud, is the largest source of illicit proceeds in the United States and represents one of the most significant money laundering threats to the United States, as highlighted in the U.S. Department of the Treasury’s most recent National Money Laundering Risk Assessment and National Strategy for Combatting Terrorist and other Illicit Financing.” Further, it should be noted that fraud is also one of the anti-money laundering/countering the financing of terrorism (AML/CFT) National Priorities.

For more details on the AML/CFT National Priorities:

https://www.fincen.gov/sites/default/files/shared/AML_CFT%20Priorities%20(June%2030%2C%202021).pdf

The alert provides directives for financial institutions when filing suspicious activity reports (SARs) involving check fraud schemes when it also involves mail theft.

SAR Filing Request:

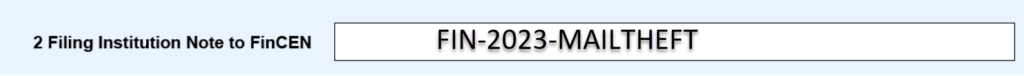

- FinCEN requests that financial institutions reference this alert in SAR field 2 (Filing Institution Note to FinCEN) and the narrative by including the key term “FIN-2023-MAILTHEFT”

- Marking the check box for check fraud (SAR Field 34(d))

The mail theft-related check fraud targets all types of checks; however, business checks tend to be more lucrative given business accounts generally carry larger balances and time to discovery may be longer for these account types. The FinCEN Alert states: “… according to the United States Postal Inspection Service (USPIS), mail theft-related check fraud is increasingly committed by non-USPS employees, ranging from individual fraudsters to organized criminal groups comprised of the organizers of the criminal scheme, recruiters, check washers, and money mules.” Blue USPS boxes are being targeted in addition to residential mailboxes and cluster mailboxes (apartments, neighborhoods, etc.)

Red Flags found in the FinCEN Alert:

- Non-characteristic large withdrawals on a customer’s account via check to a new payee.

- Customer complains of a check or checks stolen from the mail and then deposited into an unknown account.

- Customer complains that a check they mailed was never received by the intended recipient.

- Checks used to withdraw funds from a customer’s account appear to be of a noticeably different check stock than check stock used by the issuing bank and check stock used for known, legitimate transactions.

- Existing customer with no history of check deposits has new sudden check deposits and withdrawal or transfer of funds.

- Non-characteristic, sudden, abnormal deposit of checks, often electronically, followed by rapid withdrawal or transfer of funds.

- Examination of suspect checks reveals faded handwriting underneath darker handwriting, giving the appearance that the original handwriting has been overwritten.

- Suspect accounts may have indicators of other suspicious activity, such as pandemic-related fraud.

- New customer opens an account that is seemingly used only for the deposit of checks followed by frequent withdrawals and transfer of funds.

- A non-customer that is attempting to cash a large check or multiple large checks in-person and, when questioned by the financial institution, provides an explanation that is suspicious or potentially indicative of money mule activity.

Resources for customers from the FinCEN Alert:

- Mail Theft-Related Check Fraud Reporting Hotline for Victims with United States Postal Inspection Service (USPIS) at 1-877-876-2455 or https://www.uspis.gov/report

- Tips from the USPIS on how to protect against mail theft: https://www.uspis.gov/tips-prevention/mail-theft

- Customers appear to be a victim of a theft involving USPS money orders: https://www.usps.com/shop/money-orders.htm

Across the country, we have seen an increase in BSA program criticism. While BSA has been in place for a significant number of years there continues to be a need for investing resources in complying with this regulatory requirement.

Karen focuses on regulatory compliance, BSA, compliance management systems and special projects, such as compliance risk assessments and BSA assessments.

Comments are closed.